What is a Surety Bond?

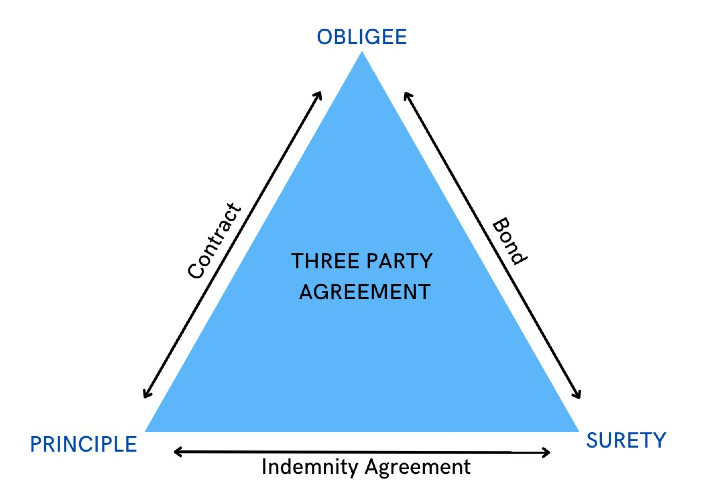

While there are many different varieties, a surety bond is simply an agreement between three parties:

- Principal: the person who needs the bond

- Obligee: the person who is protected by the bond, such as the government entity

- Surety: the person who issues the bond

Within the agreement, the surety financially guarantees to an obligee that the principal will act in accordance with the terms established by the bond. The terms established in the bond are typically dictated by a contract, license, or court order.

When do I Need a Surety Bond?

Requirements for when a surety bond is needed vary depending on which bond type is needed.

Contract surety bond

A contract surety bond is typically used to guarantee the performance of a contractor (who in this case is the principal) for a construction contract. If the contractor falls through, the surety company must secure another contractor to complete the project or reimburse the project owner for any financial loss.

The cost of a contract bond is typically based on the contract amount and will often range from 0.5% to 3% of the contract price. Surety underwriters will also consider the contractor's character, cash flow, credit score and work history during the underwriting process.

The types of contract surety bonds are:

- Bid bond: These bonds guarantee that a contractor can meet the specifications contained in the bids they submit and won't back out of a bid they've won.

- Performance bond: A performance bond protects an obligee when a contractor fails to complete a project as required. These bonds are typically associated with bid bonds.

- Payment bond: Payment bonds guarantee that the contractor will pay its subcontractors, laborers and material suppliers as specified in the contract. This type of bond is required in most large federal and commercial construction projects.

- Maintenance bond: Also called warranty bonds, these protect the project owner from losses arising from faulty materials or defective workmanship on the construction project. The typical term is one to two years.

It is important to choose the right bonding comapany to provide your company with bond solutions which tailor to your specific bonding needs. ProSure Group has been specializing in contract bonds across all industries for over 30 years. Visit ProSure Group's Contract Bond page today for more information or to begin the process of obtaining your contract bond today!

Commercial surety bond

A commercial surety bond is required by governmental entities to protect public interests. These bonds are typically used by licensed businesses to ensure they conform to all regulations and codes as they relate to the well-being of the public. Examples of principals include licensed contractors, automobile dealers, lottery-ticket sellers, liquor stores, notaries, and other licensed professionals.

Surety bonds in the construction industry usually ensure that a bonded principle will fulfill the obligations listed in a signed contract. If a bonded principal defaults on the contract, then the surety guarantees that the obligee will be made whole. This includes either taking action to make sure the work is completed according to the terms of the contract or a financial payout.

The types of commercial surety bonds include:

- License and permit bonds: These are required by government agencies when professionals or businesses apply for a license.

- Other types: Specialized commercial surety bonds apply to liquor companies, utilities, warehouse companies, auctioneers, lottery-ticket sellers, auto dealers, fuel sellers, travel agents, agricultural companies and various other companies or situations. Because surety bond requirements are typically set by government entities, commercial bond requirements can vary greatly between cities, counties, and states.

Visit ProSure Group's Commercial Bond page HERE for more information, or to get bonded today!

Fidelity surety bond

Companies buy fidelity surety bonds to protect themselves from employee dishonesty and theft. They are important for companies that deal with expensive items or large amounts of cash. Fidelity surety bonds cover businesses, as well as current, former, and temporary employees and directors, trustees, and partners.

There are three types of fidelity surety bonds:

- Business services bond: These protect against employee theft of or damage to client and customer assets, such as money, personal belongings, and supplies.

- Employee dishonesty bond: This type of bond protects a business from losses due to employees' dishonest behavior. It is often used by nonprofit organizations.

- ERISA bond: ERISA bonds are required by institutional investors and pension plans to protect participants from malpractice by employees who manage retirement plans.

ProSure Group has experts standing by to help you with all your Fidelity Bond needs. For more information, or to get started on a Fidelity Bond Application, visit of Fidelity Bond page HERE!

Court surety bond

Court surety bonds protect persons or companies from losses during court cases. These are typically used by both plaintiffs and defendants, as well as estate administrators. Common types include:

- Administrator bond: This type of bond ensures that the administrator of an estate performs their court-appointed duties. It is typically used when the estate's owner died without a will or did not designate somebody to execute the will.

- Guardianship bond: These bonds guarantee that guardians will act in the interest of incapacitated persons and minors.

- Attachment bond: Courts are required to have these before they seize a person's property, as they guarantee that defendants will be paid for any damages resulting from the seizure.

ProSure Group has Court Bond specialists who can help walk you through the entire bonding process and answer any questions you may have along the way. For more information, or to get started on the court bond application process, visit our court bond page HERE!

To find out more about surety bonds and if they are right for your business, contact The ProSure Group, Inc. Our advisors are eager to help you receive the proper coverage for your business.